Depreciation

Advertisement

Depreciation 4562 Pro

Depreciation 4562 Pro is a complete fixed asset system which includes book and tax depreciation, management reporting, and asset tracking. Current tax rules for depreciation are built in, to guide you through the process of adding assets to meet federal

Advertisement

Real Estate Depreciation TReXGlobal.com

Most taxpayers dont segment their assets to maximize deductions using real estate depreciation software like DepreciateEm. This real estate depreciation maximizer includes features that calculates depreciable basis and accounts for closing costs. Use

AcQuest HQ Depreciation v.2 40

AcQuest HQ Depreciation is designed to run on Windows 95, 98, Me & XP. The unregistered version will calculate federal and GAAP depreciation, with the unregistered version limitation that open years cannot be rolled forward.

AcQuest Pro Depreciation v.5 1

AcQuest Pro Depreciation is designed to run on Windows 95, 98, Me, & XP. The unregistered version will calculate federal, GAAP, state, AMT, and ACE depreciation for multiple companies,

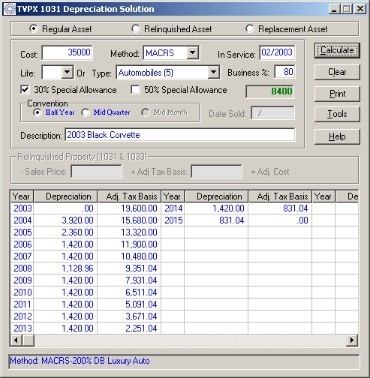

TVPX 1031 Depreciation Solution v.5.0.0001

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation. All depreciation and amortization methods required for federal tax reporting are included in an easy to use calculator format.

TBS Easy Fixed Assets v.6 2

TBS Easy Fixed Assets will keep track of fixed assets, by location or asset no., calculate monthly depreciation amounts, prints reports.

Canadian Asset Amortization Tool v.5.00

Canadian Asset Amortization Tool (C.A.A.T.) provides a historical record of capital assets and calculates amortization (depreciation) on those assets for financial statement purposes. C.A.A.T.

Asset Keeper v.25 1

Asset Keeper is a fixed asset depreciation software program that is fully-featured to meet the challenging needs of the accounting professional, yet intuitive to allow non-professionals to maintain their fixed asset data.

Minisoft AssetAge v.5 3

Assetage organizes fixed assets accounting in comprehensive formats, performs complex depreciation calculations quickly and easily, and offers powerful reports for financial and tax reporting of fixed assets.

MTW F/A Manager v.2.0.1

MTW F/A Manger is a complete fixed asset system which includes 5 depreciation books , management reporting, and asset tracking. Current tax rules for depreciation are built in,

TVPX 1031Depreciation Solution v.5.5

TVPX 1031 Depreciation Solution is an extremely efficient way to calculate federal and book depreciation.